Investments are one of the easiest ways to acquire wealth over time, but the field is complex and full of diverse opportunities. Real estate funds are a type of mutual fund investment that is linked to income-generating commercial real estate properties. Funds that are sourced from multiple investors should be managed by a professional to maximize the success of the investment.

Real estate funds can take many forms, and the requirements for investing will vary. The list of benefits includes tax advantages, high profitability, and opportunities for diversification.

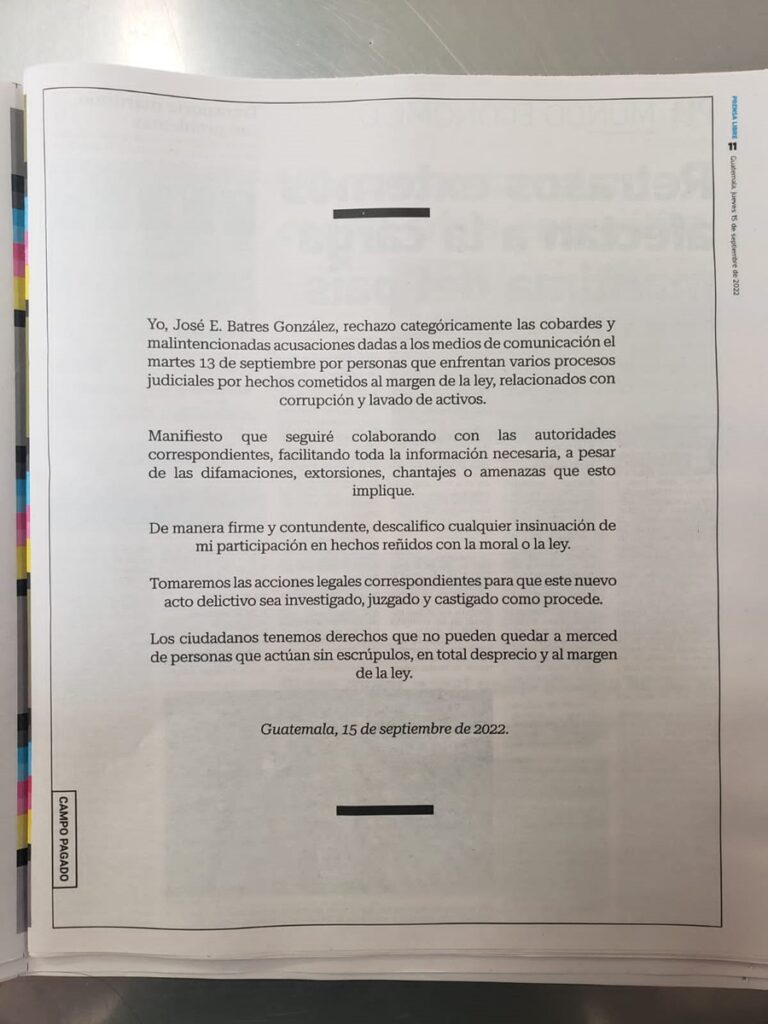

Below, Jose Ernesto Batres Gonzalez explores the basics of real estate funds: what they are, how they work, and what their benefits are.

Real Estate Funds Explained

A real estate fund is an investment opportunity that allows an individual to invest in large-scale commercial real estate properties. Most real estate funds function just like mutual funds, meaning they are composed of an accumulation of funds from multiple investors, and the entire sum will be managed by a professional or sponsor.

How it Works

Real estate funds can take many forms and will differ in their investor requirements quite significantly, depending on their characteristics. There are three types of real estate funds.

Exchange-traded funds are those that have a direct comparison to the function of the stock market. Real estate mutual funds are the most common and the most inclusive for new investors. Private real estate funds invest directly in commercial real estate and are only available to well-established investors.

Requirements for investing in a real estate fund can take the form of net-worth minimums, minimums and maximums for investment amounts, a minimum investment period, and more. Individuals can send liquid assets directly to their sponsor to begin investing, or they can invest using a self-directed IRA fund.

Benefits of Real Estate Funds

Whether an individual has experience investing in real estate or they are brand new to this sector, real estate funds will be associated with a number of benefits:

- Tax Advantages

Real estate funds are long-term investments, and they will be taxed accordingly. This means an investor will be able to generate income for many years and not worry about taxes until their shares are sold. Interest rates for long-term capital gains will be lower than short-term investments, allowing investors to keep more of their income.

- Profitability

Like any other type of real estate investment, real estate funds are linked to higher profitability and more dependable returns than most other types of investments. Since these funds aren’t linked to the risky ups and downs of the stock market, they are a safer option for high investment amounts.

- Investment Diversity

Aside from minimum investment amounts and an individual’s available cash, there is no limit on the number or diversity of real estate funds that can be invested in at one time. This means every investor has the opportunity to spread their investment money around to different areas of the world, different types of properties, and more to diversify their portfolio and improve their chances of success.

Final Thoughts

Overall, real estate funds are a reliable, profitable, and conveniently hands-off investment opportunity in the real estate industry. Anyone who appreciates these qualities in an investment would do well to diversify by utilizing real estate funds.